Financial Results

Overview

Johannesburg, South Africa -16 November 2015, Telkom SA SOC Limited (JSE: TKG) today announced group interim results for the six month period ended 30 September 2015.

Message from Telkom Group CEO Sipho Maseko

During the first six months of the 2016 financial year we continued with our efforts to transform Telkom and stabilise revenue, while at the same time addressing the fixed and inefficient nature of our operating cost base. The challenges we faced during the period included increasing competition and a soft economy.

Financial Capital

Despite these challenges we were able to continue to stabilise our net revenue and achieve growth of 1.2 percent year-on-year. Continuing growth in our mobile business resulted in a service and subscription revenue increase of 40.5 percent year-on-year. This included excellent growth in mobile data revenue of 68.5 percent. The decline in fixed-line usage continues with fixed voice revenue decreasing by 2.8 percent year-on year and data connectivity showing a year-on-year decrease of 5.1 percent once again impacted by the self-provisioning of infrastructure by our competitors and the intentional migration of customers from leased lines to next generation service offerings. Excluding revenue from leased lines fixed data revenue is up by 4.1 percent. We also achieved good growth in our consumer business with revenue from ADSL growing 5.5 percent.

Our debt levels increased during the period as a result of significant cash outflows and an increase in capital expenditure. The cash outflows included the:

+ purchase of Business Connexion Group (BCX) for R2.7 billion;

+ payment of a R1.3 billion dividend;

+ repayment of our maturing TL 15 bond of R1.16 billion; and

+ payment of voluntary early retirement and severance packages of R1.5 billion.

Despite these significant cash outflows our current net debt to EBITDA ratio is 0.4:1 and our gearing remains low, with a comfortable maturity profile.

The increase in our capital expenditure to R2 335 million, which is an increase of 20.4% year-on-year, is driven by our strategic objective of becoming a leading provider of converged solutions. This objective requires that we expand our mobile network and accelerate the building of our next generation network (NGN) by rapidly increasing our fibre and LTE footprints. We have intensified the funding for fibre to the home to maintain our competitive advantage and retain our existing customers.

The introduction of new technology and the acceleration of our fibre to the home initiative has affected the value of certain assets, which have been identified for decommissioning and reassessment of their useful lives. This has resulted in accelerated depreciation to the value of R97 million, which has affected our operating profit.

The progress we made towards transforming our future cost base by achieving a reduction in our workforce has resulted in a normalised employee cost decrease of R351 million, or 7.5 percent when compared to the comparative period.

The early termination of our head office lease, which is aligned with our aim of strengthening our balance sheet, extinguished a lease liability of R590 million. The move of our head office activities to our new campus in Centurion, which has been successfully completed, is another initiative intended to ensure the extraction of cost and operational efficiencies across our business.

Operating costs

Operating costs decreased by 2.3 percent year-on-year, however were significantly affected by:

+ the financial impact of the delay in our transformation initiatives emanating from the interdict against our Section 189 workforce restructuring process;

+ a contractual dispute arising from the transition of our vehicle lease supply contract from the existing supplier to a new supplier; and

+ unforeseen significant weakening in foreign exchange rates.

Productive capital

In line with optimising our operating model,we launched Openserve, our redesigned wholesale and networks division. Openserve is a distinct business unit within the Telkom group, which was formed as part of the company’s ongoing efforts to strengthen our customer focus through a more flexible and agile operating model.In September 2015, we announced our ` objective, through Openserve,to provide one million homes with access to Telkom fibre by 2018.

We are rolling out the biggest fibre open access suburb to date in Bryanston, Johannesburg, where more than 12 000 homes will have access to fibre technology by March 2016. During the period under review, we also announced we would be rolling out fibre in multiple additional suburbs in Johannesburg, Pretoria, Cape Town, Durban, Bloemfontein, Kimberley and Port Elizabeth. Telkom has been reducing wholesale prices to reduce the cost to communicate and has launched a 1Mbps DSL service to bring down the barriers to broadband access. We also previously stated that we will open copper access at 200 exchanges on a trial basis, thus effectively paving the way for a more open access approach, depending on the outcome of the trial.

In addition to achieving excellent growth in our mobile business and in particular in mobile data usage during this period, we also achieved good growth in our ADSL revenue supported by a 4.2 percent increase in our ADSL subscribers. Our new summer campaign was launched in September 2015 and we continue to drive convergence products and pricing in generous data bundles which have assisted us in improving our monthly sales.

Our efforts to migrate customers off legacy services to bundled, converged and next generation services is showing early signs of success, which is reflected in the growth in subscriptions, Metro Ethernet and Megaline services. This growth is not yet sufficient to offset the decline in our traditional revenue streams, mainly due to the lower pricing and smaller margins required to remain competitive given the aggressive pricing of our competitors.

Telkom acquired the entire issued share capital of Business Connexion Group (BCX). The comprehensive post-merger integration plan was developed, validated and is currently being implemented. BCX will focus on growing market leadership in integrated IT solutions, through vertical industry insights and client-relevant value-added offerings, specifically within the Enterprise customer space. Within the SMB segment, the focus is on cross-selling tiered and fit-for-purpose IT solutions to an established Telkom customer base.

Human capital

We are in the process of finalising our operating model with three separate strategic business units:Consumer, Enterprise and Openserve in order to further transform the business.Our workforce must be aligned to the new operating model.

During the period under review we have approved voluntary severance and retirement packages to 3 108 employees..

While it is essential that we realign our workforce and work more efficiently if we are to successfully reduce our cost base, it is also essential that we retain talent and attract new talent, especially scarce and business critical skills. We also need a friendly, reliable and competent team focused on providing our customers with the best possible service. Our efforts to right size our workforce have, of course, not been conducive to building a strong brand internally. The move to our new campus has provided us with an opportunity to reconnect with our employees. The campus offers our employees a modern environment with a variety of spaces where they can interact with one another.The next phase in managing our human capital will be to ensure that we have the correct culture, skills,processes and systems to enable Telkom to thrive.

Telkom reduced its incident frequency rate (number of incidents per 100 employees calculated over a specified period of time) from 1.97 to 1.67 during the period under review.

Intellectual capital

We are continuing to invest and transform our technology platforms and systems in order to support our aspirational business operating models for Openserve and Consumer/Enterprise. We have implemented the first release of the new integrated OSS/BSS system stack for fixed and mobile. This will add enhanced credit vetting and credit management functionality for Mobile Business and Consumer products and services; number management functionality for mobile products and services; and enhanced ePortal capabilities for mobile products and services among other capabilities.

We are also consolidating multiple system interfaces with a single front-end system for identifying and resolving service requirements and requests for customers, as well as the automation of common workflow tasks performed by our customer service agents.

These technology projects are not only aimed at ensuring that we offer our customers truly integrated products and services, but will also support us in delivering a superior customer experience by putting our customers first.

Social and Relationship capital

Our enterprise and supplier development programme, FutureMakers, is adding value to SMEs while at the same time broadening Telkom’s customer base and increasing our sales. Since its inception in May 2015, FutureMakers has received and screened over 300 applications for funding. FutureMakers is directly engaged in supporting 134 black-owned SMEs, all of which are active in the ICT sector, through access to finance, innovation hubs and business development services. To achieve its goals, FutureMakers is also creating and supporting third party distributors.

Natural capital

TTelkom is committed to minimising any possible negative impact it may have on the environment in which it operates, and to reducing our water and energy intensity. We are implementing a new water management system at Telkom Park, which will allow us to accurately measure our water usage by yearend. We have achieved a reduction of over 8 percent in our electricity consumption over the past three years through energy efficient lighting and air-conditioning control programmes. To reduce our reliance on Eskom power we are constructing an energy centre at our new head office in Centurion, which includes a 3MWp solar plant and a 3MW tri-generation plant. The centre will reduce our carbon emissions by an estimated 15 377 tonnes per year, which is the equivalent of the annual emissions of 1 742 households.

Outlook

The challenges of intense competition, the soft economy and the fixed and inefficient nature of our operating cost base will remain with us for H2 2016. As a result, the ongoing transformation of our business from both a revenue and cost perspective remains our key focus..

The difficult economic environment does not deter us from looking at innovative ways to bring more value-added services to our customers. In this regard, we have already partnered with Old Mutual to offer our pre-paid customers loyalty funeral cover valued at R10 000 at no additional cost to the consumer. We will continue to seek ways to remain true to our commitment to not only give our customer value, but also to ensure that our customer experience remains a priority for all of us at Telkom.

The non-approval of our RAN sharing agreement with MTN by the competition authorities was a disappointment. We are very pleased with the improved performance of our mobile business. As previously indicated we will continue to consider organic and inorganic initiatives to enhance and further improve the performance to our mobile business. As always with all our investments we will take a disciplined approach.

To this end, we have announced that we are considering a potential transaction to acquire all of the shares of Cell C (Pty) Ltd. We are currently performing due diligence on Cell C, and will update shareholders as the process progresses. We are confident that our mobile business will achieve breakeven on EBITDA by year end.

We also expect our acquisition of BCX to be a key enabler of future revenue growth that will provide us with additional revenue opportunities.

Group chief executive officer Sipho Maseko

Telkom acquired the entire issued share capital of BCX and

included its results in the group results from 1 September 2015

accordingly. Since the acquisition of BCX, the group consists of two

reportable segments, namely Telkom and BCX. The Telkom segment provides fixed-line access

and data communication services through Telkom

South Africa, and the mobile business, which offers

mobile voice services, data services and handset

sales through Telkom Mobile.. The BCX segment provides information and

communication services including cloud services,

infrastructure services, workspace services, global

service integration management and hardware and

network equipment sales locally, in seven African

countries, the UK and Dubai. The group announced its aspiration to implement a

more flexible and agile operating model and launched

Openserve on 13 October 2015 which will require

a reassessment of segment reporting as progress

is made in implementing the new operating and

reporting model to manage performance. Shareholders are referred to the announcement of

our annual results released on 8 June 2015 wherein

we provided financial guidance for the year ending

31 March 2016 and informed shareholders that the

board approved the disposal of Telkom’s 64.9 percent

shareholding in Trudon. The pre-conditions of the proposed sale of our stake

in Trudon were not met and therefore Trudon will

no longer be classified as a discontinued operation

and has been consolidated into the results from

continuing operations for this period. The comparative information for September 2014 and

March 2015 has been restated as a result of a prior

year adjustment relating to the reassessment of the

accounting treatment of the Telkom Retirement Fund

(TRF). This reassessment relates to the classification

of the TRF as either a defined contribution or a defined

benefit plan. Although Telkom is not exposed to asset

returns during the working lives of employees, the

rules of the TRF provide that employees who were

appointed prior to 1 September 2009 can retire

from the defined contribution plan of the TRF with

an option to receive a pension from the defined

benefit plan of the TRF. Should a retiree elect to

retire into the pensioner pool of the TRF and receive

a pension from the defined benefit fund, the employer

is thereafter exposed to longevity and the other

actuarial risk from the date of retirement onwards.

The reassessment arose from the voluntary early

retirement process concluded in August 2015 which

highlighted the impact of the option available to

employees. The pension is calculated based on the

defined contribution member share at retirement. This

change in classification and measurement impacted

on the statement of financial position, the statement

of profit and loss and other comprehensive income

as we recognised an IAS 19 non-current employee

related provision which will incur interest costs,

included in employee expenses. Further the SAICA

exposure draft on the application of IAS 19 provided

additional guidance on the actuarial assumptions that

were required to be used in the measurement of this

liability. The classification necessitated a restatement

of opening retained earnings at 1 April 2014. At

30 September 2015 the accounting obligation

balance is R1 652 billion. This provision is not

expected to represent an outflow of cash. The actuarially determined statutory valuation of the

liability and funding position of the pensioner account

in terms of the requirements of the Financial Services

Board and the Pension Funds Act differs materially

from the liability recognised in terms of IFRS. Actuaries have confirmed that the TRF is in a sound

financial position as at the statutory valuation date

in terms of section 16 of the Pension Funds Act, as

amended. As at the latest statutory valuation date

there was a surplus of R536 million in the pensioners

fund (after taking into account the solvency reserve of R2.3 billion). The group recorded a reported profit after tax of

R606 million (September 2014: R1.1 billion). This

is 43.8 percent lower than the previous period and

was mainly as a result of voluntary early retirement

and severance package costs of R1 523 million for

3 108 employees in the current period and R325

million in the comparative period for 406 employees. The one-off items above are not part of the

results from normal operations for the period under review and

have therefore also been excluded from the discussion below. The group recorded a normalised profit after tax of

R1 683 million (September 2014: R1 312 million)

and EBITDA of R5 040 million (September 2014:R4 379 million), resulting in a 13.9 percent increase

in headline earnings per share. The increase was driven by the benefit from lower employee expenses

due to a lower headcount. This was partly offset

by lower gains on foreign exchange and fair value

movements as a result of the lower gains recognised

on the underlying assets held by the cell captive and a higher income tax. Our mobile business continued its growth trajectory

representing a 43.8 percent revenue growth year-onyear.

We saw a pleasing growth of 40.5 percent year-on-year in our service and subscriptions revenue line

(excluding equipment sales) with good cost discipline leading to a 90.4 percent improvement of our Mobile EBITDA loss. We still face significant challenges with the decline in voice usage revenue accelerating, a reduction in

leased lines, our pricing being significantly eroded by competitive offerings and a concerted effort by

our competitors to gain market share by directly approaching our customer base with fibre offerings

and aggressive pricing propositions as well as building their own infrastructure. We did however, manage to

stabilise our net revenue with growth of 1.2 percent despite the challenges set out above. We managed to reduce operating costs by 2.3 percent.

This reduction was largely driven by lower employee

expenses and effective property management costs.

Increased maintenance, transformation cost and

vehicle and site lease cost partly offset these savings. We have seen a decline in the group’s cash balances

to R623 million from R4.7 billion as at 31 March 2015.

Our strong cash flow was impacted by the payment of

the declared dividend and voluntary early retirement

and severance costs. Furthermore, we financed the

purchase of BCX from the cash we had available. The conclusion of the acquisition of the entire share

capital of BCX and the termination of negotiations to

sell our 64.9% shareholding in Trudon due to certain

pre conditions not being met, have required us to

review and revise our financial guidance for the year

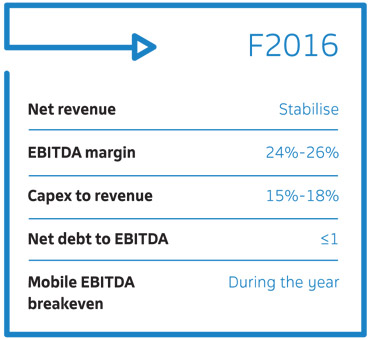

ending 31 March 2016. The revised guidance provided below includes the

financial performance of Trudon for the full financial

year and BCX for the seven months since acquisition.

The only change in guidance is the EBITDA margin from 26%-27% to 24%-26% due to the inclusion of BCX.Report structure

Results from continuing operations

Financial guidance

The financial guidance above has not been reviewed or reported on by our auditors.