Overview

Johannesburg, South Africa – 8 June 2012, Telkom SA Limited (JSE: TKG) today announced Group annual results for the year ended 31 March 2012.

Segment structure

The Group's reporting segments are business units that are separately managed. The Group consists of two reportable segments. The fixed-line segment provides fixed-line access and data communications services and the mobile segment provides mobile voice services, data services and handsets sales through 8•ta.

The "other" category is a reconciling item which is split geographically between International and South Africa. Telkom International category provides internet services outside South Africa, through the iWayAfrica group. The South African category includes the Trudon Group, Swiftnet, Data Centre Operations and the Group's corporate centre.

Comparative information has been restated to reflect the internal restructuring between the fixed-line segment and the Groupís corporate centre and to reflect the entire operations of Multi-Links as discontinued operations.

Group salient features for the year ended 31 March 2012

- ADSL subscribers increased 10.0% to 827,091.

- Calling plan subscribers increased 4.6% to 819,019.

- Managed data network sites increased 13.9% to 38,902.

- Active mobile subscribers increased 213.2% to 1,483,401 with a blended ARPU of R68.86.

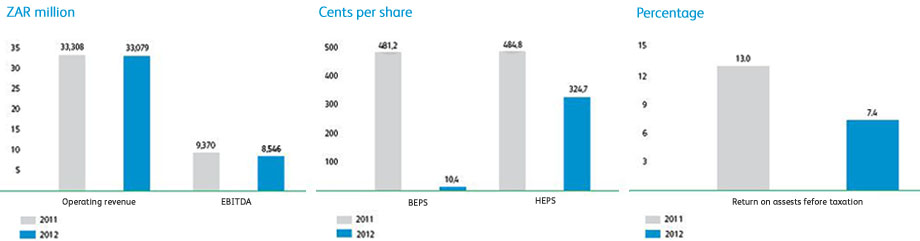

- Operating revenue down 0.7% to R33.1 billion.

- Fixed-line employee expenses decreased 15.0% to R6.6 billion.

- Mobile EBITDA loss of R2.2 billion after elimination.

- Group EBITDA margin decreased to 25.8% from 28.1%.

- Fixed-line EBITDA margin increased from 36.8% to 38.6%.

- Basic earnings per share decreased 97.8% to 10.4 cents per share.

- Headline earnings per share decreased 33.0% to 324.7 cents.

- Free cash flow generated of R2.1 billion (2011: R2.2 billion).

- Net debt to EBITDA remains 0.5x.

Statement by Nombulelo Moholi, Group Chief Executive Officer

Telkom faces many challenges at the moment but we will advance calmly, determined and focused on delivering on the promise of our business and strategy going forward. Group financial results for the year under review reflects our challenges but we took a number of significant steps towards securing a successful future for Telkom and we began casting the foundation that will allow the Group to compete well and build value in the future. It was a year of clean-up and consolidation across the Telkom Group. Our strategy going forward is clear and focused.

Our results for the year include a R896 million loss relating to the disposal of Multi-Links and an impairment loss of R569 million relating to the iWayAfrica goodwill and assets. Headline earnings per share declined 33.0% from the prior year. This is mainly as a result of the investment made in our mobile business as well as R605 million additional depreciation as a result of the review of the useful lives of existing network equipment as we invest to transform to a commercially led next generation network. This was partially offset by R739 million voluntary employee severance package costs included in the prior year.

Much has been accomplished in terms of aligning the broader strategy and consolidating our operations but there is much that still needs to be done. The group faced continued erosion of the traditional fixed-line business with fixed-line traffic revenue decreasing by 8.0%. Despite the decline in traffic volumes and pricing pressure we managed to hold the fixed-line revenue decline to 2.8%. Demand for faster products at lower prices continued to put our data revenue under pressure.

The sale of Multi-Links was concluded in October. While the process faced more challenges than we were anticipating, management is satisfied that Telkom is now better positioned to focus on delivering better results in its core business without further distraction from non-aligned operations. We believe that the negative financial and legal impacts associated with retaining Multi-Links would have had a far more negative impact on the group than divesting as quickly and proficiently as we did.

We have agreed with the Board an approach to dividend payments that is in the best longer term interests of Telkom.

The ordinary dividend has been considered with reference to Telkom's current and expected future challenges, performance, debt and cash flow levels. Telkom's strategic objectives of network transformation and the building of its mobile business will see dividends being considered on an annual basis based on the performance of the group.

Telkom has decided not to declare a dividend in respect of the financial year ended 31 March 2012. While our current financial position should allow us to fund network transformation and build our data driven mobile offering, the Board has decided that it is prudent to allow for more internally generated funding for the capital expenditures planned over the next three years. This will better position Telkom to weather uncertainties as we advance our value building strategy.