Overview

Johannesburg, South Africa - 19 November 2012, Telkom SA SOC Limited (JSE: TKG) today announced Group interim results for the six months ended 30 September 2012.

The results reflect Group profit before tax of R547 million. This is R523 million or 48.9% lower than the previous reporting period mainly due the impact of the provision for the penalty imposed by the Competition Tribunal, higher employee expenses due to annual salary increases and lower fixed-line revenue, partially offset by lower mobile termination rates and no impairment charge.

Revenue continues to reflect the impact of fixed mobile substitution that has become more prevalent over the last few years being partially offset by growth in revenue from our own mobile offering and limited revenue growth in fixed-line data. Lower prices on data due to competitive offerings continue to negate the volume growth experienced in this area.

Segment structure

The Group's reporting segments are business units that are separately managed. The Group consists of two reportable segments. The fixed-line segment provides fixed-line access and data communications services through Telkom South Africa. The mobile segment provides mobile voice services, data services and handset sales through 8ta.

The "other" category is split geographically between International and South Africa. The International category provides internet services outside South Africa, through the iWayAfrica Group. The South African category includes Trudon Group, Swiftnet, Data Centre Operations and the Group's corporate centre.

Group salient features for the six months ended 30 September 2012

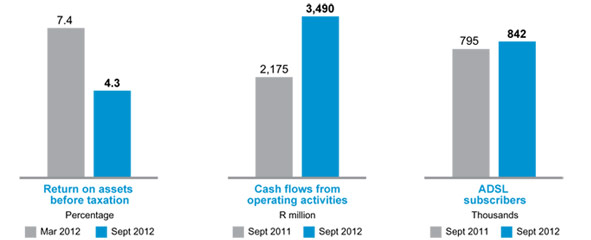

- ADSL subscribers increased 5.8% to 841,831.

- Calling plan subscribers increased 5.7% to 843,501.

- Internet all access subscribers decreased 7.3% to 516,423.

- Managed data network sites increased 8.3% to 40,284.

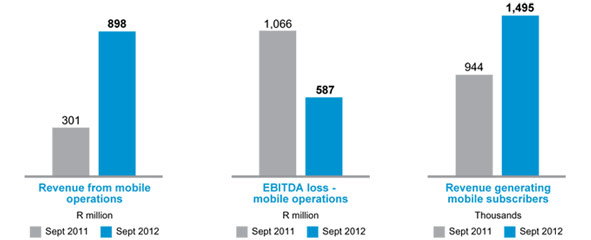

- Active mobile subscribers of 1,495,083 with a blended ARPU of R68.62

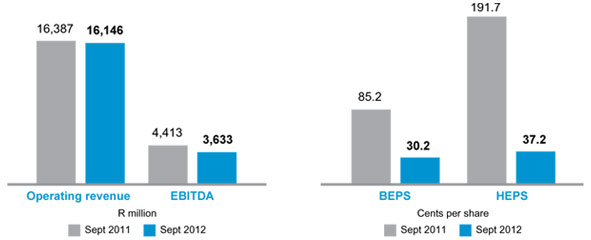

- Operating revenue down 1.5% to R16.1 billion.

- Voice usage revenue decreased 10.2% to R4.4 billion.

- Voice subscriptions revenue increased 0.8% to R3.9 billion.

- Data revenue increased 3.0% to R5.2 billion.

- Mobile revenue increased 198.3% to R898 million.

- Operating expenses increased 1.6 % to R15.6 billion.

- Fixed-line operating expenses increased 4.9% to R12.3 billion.

- EBITDA margin decreased to 22.5% from 26.9%.

- Basic earnings per share decreased 64.5% to 30.2 cents.

- Headline earnings per share from continuing operations decreased by 80.6% to 37.2 cents.

- The Group generated free cash flow of R1.5 billion, the same as the previous period.

Statement by Nombulelo Moholi, Group Chief Executive Officer:

Strategically, Telkom has reached a pivotal cross road. Telkom is engaged in constructive dialogue with its key stakeholders to chart a successful way forward.

While we also anticipate government providing an understanding of the policy direction; we will remain focused on achieving our current business strategy.

The results for the half-year to September 2012 reflect the on-going challenging environment for fixed-line incumbents. Headline earnings from continuing operations declined 80.6% to 37.2 cents from 191.7 cents in the prior reporting period largely due to the impact of the provision for the penalty handed down by the Competition Tribunal. Revenue declined marginally by 1.5% to R16.1 billion with the pressure experienced in the traditional fixed-line business through lower fixedline traffic revenue being partly offset by the growth of mobile revenue. We are encouraged by the improvement in the mobile business, which showed a 198.3% improvement in revenue largely as a result of increased ARPUs and number of revenue generating subscribers.

Operating expenses for the Group increased 1.6% to R15.6 billion due to the provision for the penalty imposed by the Competition Tribunal. Our margins declined from 26.9% to 22.5% compared to the prior reporting period. Our capital structure remains strong with cash balances of R4,829 million and net debt of R2,700 million.

While the industry landscape remains challenging for the Group we are determined to strengthen our competitiveness, improve our operating model and carefully manage our financial resources.

Our focus will remain on utilising internally generated funding for capital expenditure planned over the next year.