Financial Results

Overview

Johannesburg,South Africa - 6 June 2016, Telkom SA SOC Limited (JSE: TKG) today announced group annual results for the year ended 31 March 2016.

Message from Telkom Group CEO: Sipho Maseko

Successful execution of our turnaround strategy; the business is now ready for growth.

This financial year marks the end of the turnaround phase of our business. I am very pleased with what we have achieved despite the challenges we encountered over the period. Our solid performance demonstrates the strong execution capability we have developed over our turnaround journey. We have executed well on the targets we set for ourselves three years ago which included: de-risking the mobile business, managing traditional revenue decline, focusing on operational and capital efficiencies and improving customer experience. The mobile business has been a star performer over this phase reducing its EBITDA loss from R2.2 billion three years ago to R43 million this year. Since the fourth quarter, the mobile business has been showing sequential break-even on a monthly basis.

During the turnaround phase, as part of our Customer First programme, we introduced the Net Promoter Score (NPS) which measures customer experience. We progressed well with the upgrading of our complex legacy IT systems which were a bottleneck in serving our customers, and outsourced our call centres to specialists with the aim of improving customer support services. We remain committed to putting our customers first and will continue to implement initiatives that will enhance their experience.

To prepare our business for the future and to meet the evolving needs of our customers, we have made a substantial investment in modernising our network infrastructure to the latest technologies. During the year under review, to strengthen our core business we successfully acquired Business Connexion (BCX). Our Enterprise and BCX teams are working closely together to offer an end-to-end service to our customers. The integration of BCX and Enterprise provides us with an ability to offer solutions beyond connectivity and strengthen our leadership in Enterprise.

We also announced our intention of implementing a more flexible and agile operating model and began the process with the launch of Openserve, our network and wholesale business, in October 2015.

The objective of our new operating model, which will be supported by a lean corporate centre, is to improve accountability as well as the competitive effectiveness of each business unit relative to its peers. I am confident that we have laid a good foundation on which we can build and grow our business.

Financial Capital

Strong revenue growth boosted by the acquisition of BCX and a solid performance in data

Operating revenue grew 13.9 percent to R37.3 billion with net revenue up 3.7 percent boosted by consolidation of BCX and solid performance in data. This performance was partially offset by a 1.9 percent decline in voice and subscriptions revenue as a result of the ongoing reduction in voice usage. The fixed to mobile substitution continues and we are managing the decline in voice through offering bundled products and migrating customers from traditional voice to data based products, which has seen a reduction in the accelerating negative growth experienced in recent years.

BCX generated revenue for seven months of R4.8 billion and EBIT of R213 million before eliminations since the acquisition date. The integration of BCX which was acquired during the first half of the financial year is on track. Cybernest, previously the IT business division of Telkom, has been sold to BCX effective from 1 November 2015 to realise further synergies.

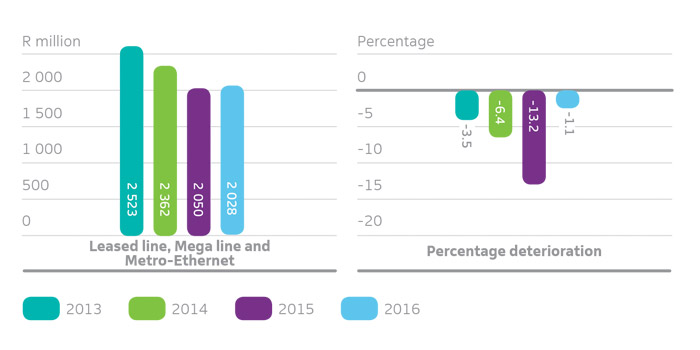

Group data revenue grew 29.2 percent mainly driven by IT services as a result of consolidating BCX. Data connectivity revenue from Metro-Ethernet and Mega lines delivered good growth of 24 percent and 46 percent respectively, which was offset by a decline in leased line revenue of 18.5 percent. We have managed to stabilise the decline in leased line revenue in the second half of the year, indicating that our migration of customers to next generation products and services and pricing strategies are proving to be successful. Excluding leased line revenue, fixed-line data connectivity revenue grew 3.4 percent.

Demand for our mobile data services surged in the period with data revenue increasing by 59.4 percent due to a 72 percent growth in mobile data traffic. The fixed-line lookalike LTE service, which offers high download and upload speeds, has performed remarkably well constituting approximately 39 percent of our data traffic. This is encouraging given that we have significantly invested in LTE and it remains one of our capital investment priorities for future growth. In addition to the outstanding operational and financial performance, Telkom was the winner of the My Broadband mobile broadband provider of the year for the second consecutive year. Telkom was also named the mobile Internet provider South African consumers are most satisfied with, according to a survey conducted by the SA Consumer Satisfaction Index.

Group achieved flat operating expenses including BCX, a commendable performance in a 6 percent inflation environment.

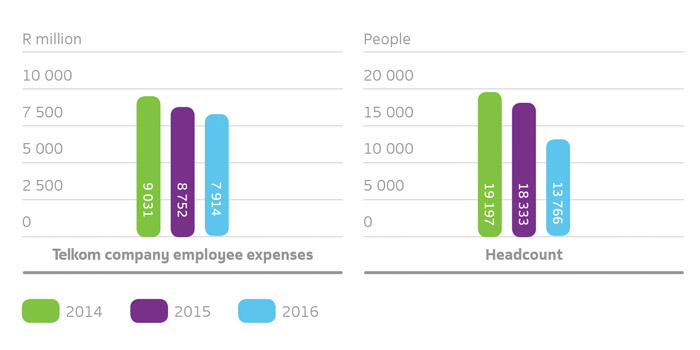

During the year, 3 878 employees accepted voluntary severance packages (VSPs) and voluntary early retirement packages (VERPs) which amounted to R2.2 billion and a further 437 employees were affected by outsourcing. Excluding this impact, employee expenses decreased by 9.6 percent in Telkom Company (excluding BCX, Trudon and Swiftnet) due to lower headcount. This was partially offset by a 4.7 percent growth in selling, general and administration expenses (SG&A) as a result of cost relating to the outsourcing of our call centres.

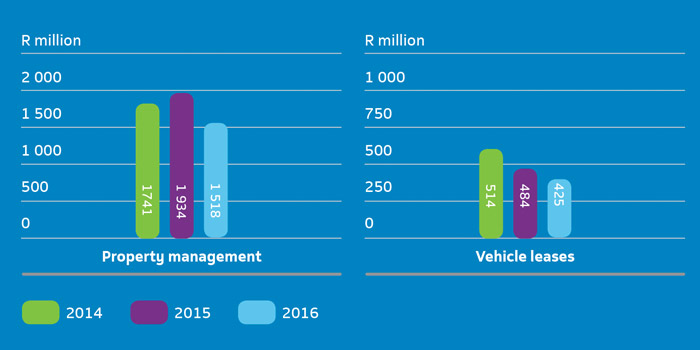

We further managed to reduce and variabilise what once was a rigid cost base as seen in our decline in property management and vehicle leases cost. With all the cost initiatives implemented through our multi-year cost efficiency programme, we have now reset the cost base and we will continue with sustained discipline over our overall costs going forward.

EBITDA increased 16.1 percent with an EBITDA margin of 29.3 percent benefiting from net revenue generated and contained costs. However, on a reported basis, EBITDA growth was lower with an EBITDA margin of 23.5 percent as a result of the inclusion of BCX in the consolidated group results.

We are pleased to report BEPS increasing by 32.4 percent to 767 cents and HEPS growing by 15.5 percent to 658 cents. The main difference between BEPS and HEPS is the gains from property, plant and equipment of R704 million.

Capex aligned to our strategic priorities in preparation of future growth.

Capex increased 16.8 percent to R6.1 billion with capex to revenue of 16.3 percent in line with our guidance. We invested in our key priority areas which include Fibre, LTE and Mobile, IT systems, maintenance and rehabilitation as well as service on demand.

In the year ahead we plan on an aggressive fibre roll-out as our number one priority while simultaneously deploying our other capital resources with a focus on revenue generation and cost efficiency as we seek to grow earnings.

Adequate balance sheet capacity to support inorganic growth and investment into the business.

Our current net debt to EBITDA ratio remains low at 0.1x, significantly below our target of 1x, providing us with sufficient capacity to fund our capex programme, invest into the core business and take advantage of any earnings accretive inorganic growth opportunities.

Group cash balances and other money market instruments reduced from R4.7 billion to R4.2 billion affected by the following significant cash outflows during the year under review:

- Purchase of BCX for R2.7 billion

- Payment of voluntary early retirement and severance packages of R1.7 billion

- Repayment of a maturing bond of R1.16 billion

- Payment of the dividend of R1.4 billion.

The board declared a dividend of 270 cents, a 10.2 percent increase on the previous year's total dividend.

Productive capital

Our strategy, designed to support the introduction of a more flexible and agile operating model, includes strengthening our customer focus, improving business unit accountability and allowing for clearer decisionmaking and faster solution delivery. Openserve's revitalisation of the broadband ecosystem and its provision of affordable broadband for all South Africans is part of this strategy. To achieve this, we have decreased the cost of IPC and SAIX to stimulate growth and provide a true broadband experience to the end users. It also allows smaller operators to enter this space which was predominately dominated by the larger operators. We also introduced a 1Mbps DSL service at a low price point to reduce the barriers to broadband access.

We intensified our fibre deployment plan by signing up more contractors to speed up our deployment to key identified areas. Our sales specialists are engaging with homeowner associations, body corporates as well as other service providers to assist us in gaining access so we can deploy fibre services to these areas. We conducted a fibre training programme for our reseller community to ensure they have a clear understanding of the product.

With the increasing demand for high speed broadband in mind, we aim to grow our broadband penetration through our fixed-line lookalike LTE services and will continue to invest in this service by re-farming our 1800 MHz spectrum to offer a fully mobile LTE service to our smartphone customers.

Our efforts to migrate customers off legacy services to bundled, converged and next generation services are showing early signs of success, which are reflected in the growth in subscriptions, Metro-Ethernet and Mega line services. Indications are that this growth will offset the decline in our traditional revenue streams. While these services are priced lower, with smaller margins required to remain competitive, it presents an attractive opportunity for us to acquire new customers.

Our investment into BCX is also proving to be rewarding, with the demand by Telkom customers for BCX services growing as we combine our sales efforts to offer end-to-end solutions to our enterprise customers. We will also harness the success of our mobile business to offer fixed mobile convergence and unified communications to our Enterprise customers. Telkom Enterprise and BCX are moving closer together as we implement our integration plan. This integration allows us to offer purpose-built digital solutions, together with integrated IT solutions, through joint vertical industry offerings to both Telkom and BCX customers.

Human capital

During the period under review we have approved voluntary severance and retirement packages to 3 878 employees at a cost of R2.2 billion with a further 437 employees being affected by outsourcing.

We have been mindful to retain talent and attract new talent, especially scarce and business critical skills. While we have achieved a substantial reduction in our workforce we retained key skills with the main reductions being in the semi-skilled category, where we reduced our workforce by 46.6 percent year-on-year, and the junior management or supervisory category, where our workforce decreased by 25.3 percent. In the middle management category our workforce decreased by 14.8 percent year-on-year and there was a 4.1 percent decrease in senior management.

It is now necessary that we focus on becoming a company whose employees would like to recommend Telkom as a good place to work, as well as recommend our products and services to their friends and colleagues. Our culture shaping programme, which began with leadership, is well underway. We believe our efforts in this regard will have a positive impact on all our employees and increase productivity and internal brand commitment.

Telkom is taking a new view on recruitment in order to attract the best talent to the transforming business. It has recently hired eight interns through an online guerrilla marketing campaign that seeks to reward new ways of approaching business challenges. The campaign used social media posts, Google ads, and email marketing. The ad copy read: "we're looking for bright young minds. If you think you're the smartest person in the room, answer this question. " The campaign generated over 38 000 hits in a two-month period. This is one way that Telkom sought a new perspective on hiring and to reward unconventional thinking, so the company took a chance with a new approach to talent acquisition.

Our investment in training and development is key to our efforts to transform our culture and ensure that we achieve our strategic objective of equipping our employees with the appropriate skills and experience to put our customers first in a very competitive ICT environment. A major training effort currently underway is the multiskilling of frontline store employees in the use of our new frontline systems, which provide an integrated view of our customer’s mobile and fixed-line products.

Intellectual capital

Our continued commitment to the transformation of our technology platforms and systems that will empower our employees to provide much improved customer experience in replacing complex consumer and enterprise legacy systems. By the end of the third quarter of 2017 we will have completed the installation of our new operations support system (OSS) and business support system (BSS) stacks for our consumer and enterprise fixedline and mobile products. This will provide us with an integrated view of our customers’ fixed-line and mobile products, and will have a major impact on the speed and accuracy of the service we can provide our customers, as well as our customer's ability to view their information online.

We will continue on our journey to replace our legacy systems with best of suite packages that will take us from standalone bespoke systems to pre-wired, pre-integrated and pre-configured systems. The next focus will be addressing the Openserve systems. This process has the added complexity of having to manage the overhaul of technology systems that are integrated with South Africa’s biggest and most complex network, as well as the management of stock and workforce scheduling.

We are also integrating BCX, which will become the IT arm of Telkom, not only providing IT services support and development to our customers, but also to Telkom. During FY2016 the first step we took in the integration of Telkom group IT (TGIT) and BCX was to integrate our Cybernest, Telkom’s data centre operations, made up of six data centres, to BCX. These operations are now managed by BCX. We are busy with the design of how the various parts of TGIT and BCX will integrate so as to best serve our business units, and plan to complete this exercise over the next 12 months.

Social and relationship capital

The primary focus of the Telkom Foundation, which is responsible for our corporate investment programme, is on education. It also invests in social development projects and runs a successful employee volunteering programme. We supported three education programmes, the Cancer Foundation’s fundraising and a xenophobia campaign.

Over 200 Telkom employees volunteered in four projects which involved 1 600 youths and 114 schools through the Rally to Read programme. Over 500 Telkom volunteers also took part in the Connected Youth projects which focused on using ICT to support youth development. Some 1 600 youth were shown how to create electronic CVs, create email addresses and explore job and other youth development websites.

In response to the drought we supported Operation Hydrate efforts to provide water to communities in the Free State province and the establishment of boreholes in the same communities.

Our enterprise and supplier development programme FutureMakers, launched in May 2015, has already approved investments in eleven black-owned small businesses. The primary objective of the fund is to enable the growth of qualifying enterprises and to promote technology innovation in the Telkom value chain and the broader technology sector through financial support and appropriate business development support. FutureMakers Hubs provided virtual and physical business incubation and development support to over 300 innovative technology businesses during FY2016 through its key partner, the Bandwidth Barn. FutureMakers Proof builds strategic relationships with key industry players to promote innovation, drive broadband uptake and improve technology usage in small business. These relationships have resulted in the training of over 300 black-owned businesses in the potential of technology to increase their business efficiencies, and improve their marketing and customer services.

FutureMakers Sourcing supports 49 Internet cafè owners with capacity building, business tools, technology, connectivity, selected infrastructure, as well as the establishment of new revenue streams. It has also partnered with ABI to support their Bizniz in a Box youth economic inclusion and empowerment programme, which through providing training, mentorship, business and technical support helps unemployed youth to own and run Internet cafè-cum-spaza shops in refurbished shipping containers.

FutureMakers, recognising that every individual and business that acquires new technology and tools will need technical support, has set up the independent field technicians (IFTs) pilot project, which will offer structured funding for IFTs that allows them to lease technician vehicles. There are already 12 people working for three new technical support businesses supported by the FutureMakers IFT project. The number of technicians benefitting employment is currently being increased to 65 working in 13 new companies that are being inducted to the IFT. We have equipped them to work on our network and are providing them with work and also encourage them to offer their services to other network operators. We believe they will grow into sustainable businesses providing a wide range of services to telecommunications, video entertainment and Internet companies throughout South Africa. The majority of the people working in these companies are ex-Telkom employees and these businesses offer them a more independent remuneration option.

Natural capital

Telkom is committed to minimising any possible negative impact it may have on the environment in which it operates, and to reducing our water and energy intensity. While Telkom is categorised as a medium to low risk organisation in terms of the impact of our activities on the environment we are committed to addressing the causes and adapting to the impacts of climate change.

We are constructing a large solar farm on our new campus in Centurion. The first phase of this project will produce 1MW of electricity and will go live in July 2016. Another megawatt will go live every month until the project is completed, at which time it will generate 3MW of electricity.

When completed, its panels will cover 1 800 carports specially positioned to absorb as much sunlight as possible. The project will also make electrical points available for charging electrically operated vehicles. The next phase of our head office energy project will include a 3MW tri-generation plant which would allow us to be self-sufficient in terms of our electricity requirements for our head office. Once completed these initiatives will reduce our carbon emissions by an estimated 15 377 tonnes a year, which is the equivalent of the annual GHG emissions of over 1 742 households.

Outlook

Having completed the turnaround phase of our strategy, we are embarking on the next phase, the transformation to growth of our business. This entails moving from an efficiency to a growth bias as we focus on implementing our new operating model, while maintaining a cost efficiency focus.

Investing in high speed broadband, content and IP services, IT and value added services is a key part of our strategy to transform and exploit the potential of our business going forward. These, we believe, will serve towards strengthening our core business.

A relentless focus on customer service will also always be part of our strategy, as will implementing the right processes and systems to enable and empower our employees to contribute towards improved customer centricity. Our culture shaping programme will play an important part in creating an environment where our people can flourish and give of their best.

Group chief executive officer

Sipho Maseko

Declaration of dividend

Ordinary final dividend number 18 of 270 cents per share (March 2015: 215 cents and a special dividend of 30 cents) in respect of the year ended 31 March 2016 has been declared payable on Monday, 4 July 2016 to shareholders recorded in the register of the company at close of business on Friday, 1 July 2016. The dividend will be subject to a local dividend withholding tax rate of 15 percent which will result in a net final dividend of 230 cents per ordinary share to those shareholders not exempt from paying dividend withholding tax. The ordinary dividend will be paid out of cash balances.

Dividend policy

The ordinary dividend has been calculated with reference to Telkom's current financial performance, current and future debt and cash flow levels. Telkom's turnaround and transformation over the last three years has been a success and as such the business has been stabilised and positioned for growth. Our intention is to grow our dividend on an annual basis taking into account financial performance, capital and operating expenditure requirements, the group's debt levels and available growth opportunities.

The number of ordinary shares in issue at date of this declaration is 526 948 698.

Telkom SA SOC Limited's tax reference number is 9/414/001/710.

Salient dates with regard to the ordinary dividend 2016

| Declaration date | Monday, 6 June 2016 |

| Last date to trade cum dividend | Friday, 24 June 2016 |

| Shares trade ex dividend | Monday, 27 June 2016 |

| Record date | Friday, 1 July 2016 |

| Payment date | Monday, 4 July 2016 |

Share certificates may not be dematerialised or rematerialised between Monday, 27 June 2016 and Friday, 1 July 2016, both days inclusive.

On Monday, 4 July 2016, dividends due to holders of certificated securities on the South African register will either be transferred electronically to shareholder's bank accounts or, in the absence of suitable mandates, dividend cheques will be posted to such shareholders

Dividends in respect of dematerialised shareholders will be credited to shareholder's accounts with their relevant CSDP or broker.

With reference to special resolution number 8 passed by shareholders at the annual general meeting on 7 August 2014 we will only be paying dividends via electronic funds transfer (EFT) and therefore request all shareholders to provide Computershare with their banking details immediately. Computershare may be contacted on 011 370 5000.

Report structure

Telkom acquired the entire issued share capital of Business Connexion (BCX) and accordingly included their results from 1 September 2015 in the group results. Cybernest, previously the IT business division of Telkom, has been sold to BCX effective 1 November 2015 to realise synergies. Through the acquisition of BCX and the sale of Cybernest to BCX we are expanding our IT services offering, integrated and end-to-end solutions and delivering capability. The results of BCX for the seven months ended 31 March 2016 before inter-group eliminations are disclosed in annexure A.

Since the acquisition of BCX, the group consists of two reportable segments, namely Telkom and BCX.

The Telkom segment provides fixed-line access and data communication services through Telkom South Africa, and offers mobile voice services, data services and handset sales through Telkom Mobile.

The BCX segment provides information and communication services including cloud services, infrastructure services, workspace services, global service integration management and hardware and network equipment sales locally, in seven African countries, the UK and Dubai.

Results from continuing operations

Shareholders are referred to the announcement of our annual results released on 8 June 2015 wherein we provided financial guidance for the year ending 31 March 2016 and informed shareholders that the board approved the disposal of Telkom's 64.9 percent shareholding in Trudon.

The material conditions precedent of the proposed sale of our stake in Trudon were not met and therefore Trudon will no longer be classified as a discontinued operation and has been consolidated into the results from continuing operations for the year.

The comparative information for March 2015 has been restated as a result of a prior year adjustment relating to the reassessment of the accounting treatment of the Telkom Retirement Fund (TRF). This reassessment relates to the classification of the TRF as either a defined contribution or a defined benefit plan. Although Telkom is not exposed to asset returns during the working lives of employees, the rules of the TRF provide that employees who were appointed prior to 1 September 2009 can retire from the defined contribution plan of the TRF with an option to receive a pension from the defined benefit plan of the TRF. Should a retiree elect to retire into the pensioner pool of the TRF and receive a pension from the defined benefit fund, the employer is thereafter exposed to longevity and the other actuarial risk from the date of retirement onwards. The reassessment arose from the voluntary early retirement process concluded in August 2015 which highlighted the impact of the option available to employees. The pension is calculated based on the defined contribution member share at retirement. This change in classification and measurement impacted on the statement of financial position, and the statement of profit and loss and other comprehensive income as we recognised an IAS 19 non-current employee related provision which will incur interest costs, included in employee expenses. Further the SAICA exposure draft on the application of IAS 19 provided additional guidance on the actuarial assumptions that were required to be used in the measurement of this liability. At 31 March 2016 the accounting obligation balance is R1 274 million. This provision is not expected to represent an outflow of cash.

The actuarially determined statutory valuation of the liability and funding position of the pensioner account in terms of the requirements of the Financial Services Board and the Pension Funds Act differs materially from the liability recognised in terms of IFRS. Actuaries have confirmed that the TRF is in a sound financial position as at the statutory valuation date in terms of section 16 of the Pension Funds Act, as amended. As at the latest statutory valuation date there was a surplus of R536 million in the pensioners fund (after taking into account the solvency reserve of R2.3 billion).

The group recorded a reported profit after tax of R2.4 billion (March 2015:R3.2 billion). This is 25.4 percent lower than the previous period and was mainly as a result of voluntary early retirement and severance package costs of R2 193 million for 3 878 employees (a further 437 affected by outsourcing) in the current period and R591 million in the comparative period for 1 205 employees.

The once-off items discussed higher in this section are not part of the results from normal operations for the period under review and have therefore been excluded from the discussion below.

The group recorded a normalised profit after tax of R4 052 million (March 2015: R3 064 million) and EBITDA of R10 954 million (March 2015:R9 432 million), resulting in a 15.5 percent increase in headline earnings per share. The increase was driven by higher mobile data revenue, gains on sale of assets and the benefit from lower employee expenses due to a lower headcount. This was offset by lower gains on foreign exchange and fair value movements as a result of the lower gains recognised on the underlying assets held by the cell captive and a higher income tax charge.

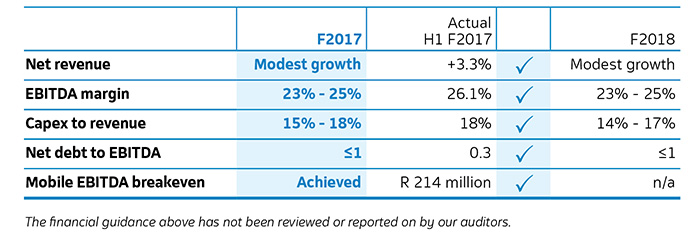

Financial guidance

The financial guidance above has not been reviewed or reported on by our auditors.