Financial Results

Overview

Johannesburg, South Africa – 15 November 2016, Telkom SA SOC Limited (JSE: TKG) today announced Group interim results for the period ended 30 September 2016.

Message from Telkom Group CEO Sipho Maseko

The group delivered a solid performance in a tough economy where businesses continue to operate under pressure. The consolidation of Business Connexion (BCX), as well as the satisfactory performance of our mobile business, drove revenue performance during the six months. The mobile business has contributed positively to the group’s EBITDA in the reporting period. Our multi-year business transformation also contributed positively. I am pleased that we remain on track with our market guidance, despite the macro-economic challenges.

Customer experience remains a priority. We have undertaken a process redesign that will simplify and improve the quality of interactions with our customers. As part of our systems redesign programme, we have also progressed well with the fixed and mobile convergence platform for our consumer and enterprise business. This convergence will allow our customers to have a single view of their account by the end of the financial year.

As from November, we have integrated our Enterprise business with BCX. Isaac Mophatlane has been appointed as the CEO of the merged entity, BCX. The combined entity will be our Enterprise go-to-market entity and is the only truly converged business in the market which offers end-to-end solutions to Enterprise customers. BCX remains a key growth platform for the group through which, among others, cloud computing and the Internet of Things (IoT) is delivered.

Financial Capital

BCX boosting revenues

Operating revenue grew 20.6 percent to R20.2 billion with net operating revenue up 3.3 percent boosted by the consolidation of BCX in the period, along with robust performance by the mobile business.

BCX was consolidated for the six months, reporting revenue of R3.6 billion compared to one month revenue of R489 million in the prior corresponding period. Excluding BCX, operating revenue and net operating revenue grew 2.0 percent and 0.9 percent respectively attributable to the mobile business.

Broadband strategy yielding sound results

Mobile broadband revenue grew 43.2 percent to R1.0 billion supported by 2.3 million mobile broadband customers, an increase of 44.5 percent compared to the prior corresponding period. We now have 70.8 percent of our customer base using data at an average of 2.7 Gigabytes per customer per month. During the period, we re-farmed our 1 800 MHz spectrum to extend our LTE offering to smartphones. Our smartphone base has grown by 43.7 percent to 1.6 million. On the back of the upgrade of our network, in July we launched a groundbreaking broadband-led product, called FreeMe. Early indications show significant increase in gross connection monthly run rates and an uplift in ARPUs in the two month period. We are also observing good growth in our nomadic LTE offering, particularly in multi-dwelling areas. Here we have seen LTE customers more than doubling from the prior corresponding period, with an average usage of 25 Gigabytes per customer.

Fixed data connectivity revenue increased slightly at 0.5 percent to R3.3 billion after a year of decline. The turnaround in the fixed data connectivity is as a result of successful migration of customers from legacy leased lines to Megalines and Metro-Ethernet.

Group EBITDA positively impacted by multi-year business transformation

Group EBITDA grew 4.6 percent to R5.3 billion with a margin of 26.1 percent, slightly ahead of our margin guidance. This is mainly due to lower headcount which reduced by 14.3 percent to 12 184 and company employee expenses reducing by 14.6 percent.

We achieved efficiencies from our service fees and operating lease expenses as a result of cost saving initiatives implemented during the turnaround phase. These actions included effective property management and the change in our vehicle fleet. These savings were partly offset by an increase in selling, general and administration costs due to outsourcing and our focus on service improvement. The mobile business contributed positively to the group EBITDA. This is the first reporting period it has recorded positive EBITDA of R214 million.

HEPS and BEPS up on improved operating profits

Normalised HEPS grew 19.7 percent to 336.0 cents and normalised BEPS grew 8.6 percent to 348.7 cents benefiting from 8.2 percent growth in profit after tax.

Capex deployed to modernise our network

Capex increased 55.8 percent to R3.6 billion with capex to revenue of 18.0 percent at the top end of our guidance. The largest portion of our capex was deployed to revenue-generating areas which are our fibre deployment zones and serving the acceleration of mobile growth. Fibre to the premises remains our key priority as we increased the number of homes passed with fibre to 144 512 and ports activated via MSAN access to 1 278 430.

Through the re-farming of 1 800 MHz spectrum, we have successfully expanded our LTE services to smartphones. We invested in our LTE network expanding the number of integrated base stations by 10.9 percent to 1 532. This has enabled the ever increasing growth in data traffic. We continue to invest in the upgrade of both our mobile and fixed line networks, in line with global trends to improve our product offering and customer service.

Interim dividend

Group’s net cash and cash equivalents of R1.8 billion subsequent to a dividend payment of R1.4 billion, capital investment of R3.5 billion and R522 million voluntary early retirement and severance packages provides the group with sufficient liquidity amid economic and market uncertainties.

Our strong cash generating ability has enabled us to introduce an interim dividend of 131 cents per share.

Strong balance sheet to fund growth

Our current net debt to EBITDA ratio remains low at 0.3 times, below our target of 1x providing us with sufficient capacity to invest and grow the business.

Productive capital

Consumer business driven by the performance of mobile business

The mobile business recorded strong service revenue of 36.7 percent driven by strong customer growth of 42.3 percent to 3.2 million active customer base. However the blended ARPU was relatively flat at R89. We will continue to utilise our focused Customer Value Management (CVM) activities to grow ARPUs from existing postpaid customers as well as cross selling additional products to current customers.

CVM customer retention activities on postpaid customers have led to postpaid churn stabilising, to marginally over 10 percent. The splendid performance in Mobile was as a result of additional stores and channels, competitive products and pricing such as Deal of the Month campaigns, along with the recent launch of FreeMe. The mobile business contributed positively to group EBITDA in the period compared to a negative EBITDA contribution in the prior corresponding period.

Our FreeMe product offers customers a data bundle with voice, WhatsApp calls, text for free and free Wi-Fi. According to an analysis by Tariffic, the FreeMe packages are the top choice for high data and voice users in South Africa.

FreeMe continues to be a very popular offering with customers and has performed even better than our initial expectations. We saw increased gross connections from both existing customers and new to franchise customers. The migration of customers from postpaid legacy plans to FreeMe will begin in November 2016. With 1.6 million smartphones on our base, we will be able to leverage FreeMe. In the period we sold approximately 170 000 prepaid FreeMe bundles, with over 70 percent of sales coming through our channels.

In the fixed business, we have seen a significant demand for fibre including existing ADSL customers migrating to fibre. However we encountered operational issues with fulfilment of orders including the impact of the industrial action. We are currently reviewing our processes in order to improve fulfilment.

The Small Business unit launched a voice and broadband failover service for small businesses, where the call is automatically redirected to mobile or a secondary number, if the fixed line is not available.

Leading in the fibre market

As part of our strategic intent to modernise our network, fibre continues to drive this transformation by covering multiple fibre connection points to homes, businesses, cabinets and base stations. Despite an intensely competitive market and operational challenges encountered as a result of the industrial action in August, we have been able to improve our ability to roll out and connect our customers to their choice of broadband access. While we drive the fibre rollout, we continue to see a market need for utilising our existing network, enabling access to Internet at the required speeds. To this end, we have seen an increase in ports activated via MSAN access by 24.1 percent to approximately 1.3 million homes passed.

Fibre to the home increased to 144 512 homes and 850 gated communities. The current connectivity rate is above 13 percent and growing steadily. We are confident that with our multiple deployment strategies and initiatives already underway, this number will continue to increase over the next twelve months. With our improved client services structure, we have increased the number of partnerships with resellers thus giving further impetus to connectivity rates.

We have approximately 42 176 fibre connections to business premises. This allows us to provide multiple services with high speed links to all major corporates in South Africa catering for their major site requirements as well as lower speed fibrebased Metro-Ethernet links, for the branch connectivity.

We are currently providing fibre links to approximately 5 600 base stations. We believe that our pricing and engagement strategy is making headway in reducing selfprovisioning. The strategy is also stimulating growth in our Megaline circuits and other products that service the requirements of our clients at the base stations.

As part of the transformation journey, a significant reduction in headcount was achieved while retaining the critical skills. The key skills retained will ensure we are able to realise our strategic imperatives of modernising our network, while also improving our service delivery.

We were negatively impacted by the industrial action that took place in August, which not only impacted our ability to maintain service levels, but also resulted in malicious damage to our infrastructure. We continue to work on ensuring our clients and customers are provided the high quality service they deserve and we have tirelessly worked to reduce the number of challenges we experience on our legacy network.

BCX: Integration realising synergies In the first half of the year, the Enterprise division of Telkom and BCX worked together to implement the integration plan, under CEO Isaac Mophatlane’s leadership. Synergies were realised through cross selling to each other’s customer base, thanks to a go-to-market strategy which was well received by customers. In addition, the teams won business together as they leverage on their ability to offer end-toend solutions to Enterprise customers.

However the challenging economic environment impacted these businesses which are exposed to public sector and corporates that remain under economic pressure. In addition, BCX is exposed to foreign currency volatility, particularly in Nigeria and Mozambique. We are currently building resilience in the merged business, to respond to these challenges.

Human capital

The Collaborative Partnership Agreement (CPA) signed with two of our three unions earlier this year included a ground-breaking commitment to a new employee incentive scheme for bargaining unit employees which focuses on the impact an individual can have on overall customer experience and profitability. This scheme, known as Performance Pays, has now gone live, and offers all employees the opportunity to earn up to 12 percent per month on top of their basic salary. The industrial action, driven by a single union that did not sign the CPA, lasted for six weeks. All striking employees returned to work and are benefiting from the implementation of the Performance Pays model.

During the course of 2016, Telkom has seen a stream of talented senior executives joining the business. What is most exciting is the diversity, experience and breadth of the talent seeking to join Telkom. In 2016 alone, we have seen 20 senior executives joining the team. The majority of those are female and over three quarters are black. Their backgrounds include banking, mining, telecommunications, technology and management consultancy.

Telkom has been focusing on innovative and disruptive recruitment into the business at all levels:

- Our first Bright Young Minds programme, launched in 2015, attracted eight of the best and brightest interns in the country;

- Our ongoing involvement with “WeThinkCode” is creating an exciting new pipeline of very young, talented coders to join our business;

- We have developed a strong talent management approach and have recently launched the senior executive “Step Up” development programme.

- Our Female Leadership Development programme is now in its third year.

- A new, digitally focused career and leadership development programme will be launched in 2017. We believe the programme will be the first of its kind in the country and will reach out to support all employees.

Intellectual capital

The platforms for growth

After three years of working on the new Operations Support System and Business Support System (OSS/BSS) solution for Consumer and Enterprise, the integrated fixed and mobile platform has been completed and the migration of Consumer customers from the legacy systems onto the new platform has commenced. Consumer customer migration is expected to complete during the financial year.

Once migrated we will be able to sell fixed and mobile converged services to our Consumer customers through our new IT platform. This will allow customers to access a single view of their account for their fixed and mobile usage, in one statement. In turn, our business units are able to utilise customer value management in a more comprehensive and efficient way.

We are further redesigning processes that will simplify and improve the quality of interactions with our customers. In the period, we have introduced process efficiencies in our stores, reducing time to capture customer information, credit vetting and approvals amongst others. We have also introduced a system called VDox which eliminates paper and contract documentation in our Telkom Stores. Our applications process is now automated and paperless with an application secured using an electronic signature on a screen.

We will now embark on implementing a separate OSS/BSS solution for Openserve to ensure equivalence of service through retail/wholesale separation. Once all fixed and mobile converged platforms are in place for all our business units, we will begin decommissioning our legacy systems.

In the period, we have introduced process efficiencies in our stores, reducing time to capture customer information, credit vetting and approvals amongst others. We have also introduced a system called VDox which takes away paper and contract documentation in our Telkom Stores. Our applications process is now automated and paperless with an application secured using an electronic signature on a screen.

Natural capital

Telkom continues to invest in renewable and sustainable forms of natural resources management.

Of particular note in this period has been a 3MW solar farm going live at Telkom’s Head Office, the largest privately owned installation of its kind in Africa. The solar farm is capable of producing the entirety of Telkom’s Head Office power requirements for its staff during daylight hours. The solar farm assist in carbon displacement to improve our sustainability ratios.

Telkom has invested in new machine to machine technology which enables active energy consumption monitoring at our largest 50 sites, and facilitates the ability to manage our energy consumption at these sites in real time. It is planned to roll-out further sites later this year.

At several of our larger sites, water harvesting and recycling plans are well advanced and will enable Telkom to fundamentally reduce water consumption in future years.

Social and relationship capital

Growing skills, growing businesses

The Telkom Foundation’s key focus is on education and in particular:

- The teaching and learning of maths, science, technology and English through the use of technology through the Connected Schools programme;

- Through partnerships with various academic institutions such as the North West and the Nelson Mandela Metropolitan Universities, the Foundation provides supplementary teaching to just under 4 000 learners in five provinces. Over time, we have seen steady learner performance improvements in the various supported schools.

During the 2016 winter holidays, the Foundation initiated a programme to expose young learners between the ages of 12 and 16 to a coding skills programme. This coding training was targeted at 20 learners from two Gauteng partner schools. A key outcome of this programme is seeing learners who have had no prior exposure to computers, designing and developing a school website on their own.

The Foundation is working with the FutureMakers programme to increase its reach of young people exposed to coding as a core skill in the ICT space. Together with FutureMakers, the Foundation partnered with a non-profit organisation (“We ThinkCode”), which specialised in training young and unemployed South Africans in the art and science of coding. Our objective is, with them, to help build a pipeline of coders to be absorbed into the FutureMakers programme.

Participants have an opportunity to develop various applications which could be given commercial exposure. This partnership will not only provide the pipeline but will create a platform for young people to gain employability, or even access enterprise development opportunities.

The key focus of FutureMakers, our enterprise and supplier development programme, is to support small black-owned enterprises. We particularly focus on the supply chain, channel development and in the development of innovation solutions. We have approved financing for eleven black-owned small businesses, which have been approved via the FutureMakers investment fund. Our business incubation spaces support more than a 1 000 entrepreneurs in the technology and innovation sector. We are also building strategic relationships with key industry players such as Microsoft and Cisco. Through these partnerships we aim to promote innovation, drive broadband uptake and improve technology usage in small business.

A total of 17 Internet cafés have been set up through the FutureMakers programme and are driving prepaid products in their communities across the country. The Internet cafés received capacity building support, business tools, access to technology, connectivity and selected infrastructure. To grow Telkom’s ability to expand market penetration, 13 black-owned companies have been inducted into Telkom channel development as dealers, receiving financial and non-financial support. These companies sell Telkom products to consumers and small businesses. Telkom has already seen revenue generation through the dealers, which proves the programme’s commercial relevance, while delivering transformation.

We also launched the Independent Field Technicians (IFTs) project, which assists former Telkom employees to run their own companies and form part of the Telkom supply chain. The IFT programme has expanded from three black-owned companies to 20 companies employing 139 technicians, focusing on ADSL faults and new installations. These companies are supported through provision of access to procurement contracts, business development support, tools, working capital and access to leased vehicles. 20 Overview 21 The Telkom Foundation’s key focus is on education and in particular; • The teaching and learning of maths, science, technology and English through the use of technology through the Connected Schools programme; • Through partnerships with various academic institutions such as the North West and the Nelson Mandela Metropolitan Universities, the Foundation provides supplementary teaching to just under 4 000 learners in five provinces. Over time, we have seen steady learner performance improvements in the various supported schools. During the 2016 winter holidays, the Foundation initiated a programme to expose young learners between the ages of 12 and 16 to a coding skills programme. This coding training was targeted at 20 learners from two Gauteng partner schools. A key outcome of this programme is seeing learners who have had no prior exposure to computers, designing and developing a school website on their own.

Outlook

Despite the increased competition in the market, we are in a good position to execute on our strategy. However the tough economic environment presents a challenge, as BCX, including the Enterprise business, is particularly impacted by these adverse conditions.

Nevertheless, we are committed to our sustainable growth framework for the group. We will continue to deploy capital to the growth areas of the business which will ultimately grow our revenue. Our capital investment has given priority to Fibre to the premises and the mobile business as we see these areas as growth platforms for our businesses.

We will continue to modernise our network with the intention to migrate customers from legacy to fibre. This programme is expected to increase the utilisation of our network and, over time, improve returns.

Our mobile business has been able to establish itself as a meaningful player in the market. We intend to grow our scale in the mobile market through focusing on the postpaid and data market where we are already making inroads.

The integration of Enterprise business with BCX is another growth platform through which cloud computing, data analytics and Internet of Things (IoT) among others, will be delivered. Telkom Group Information Technology (TGIT) functions will be migrated from corporate group and be integrated into BCX, Consumer and Openserve. Going forward, BCX will be responsible for maintaining and supporting our IT production and development systems and will manage all data centre operations.

We will continue to drive efficiencies and exercise cost and capital discipline throughout the business. We will also continue to focus on skills, expertise, simplification of processes and the ongoing upgrade of our IT systems and network to ensure sustainability of our business and improved customer service.

Dividend policy

The board has decided to amend the current dividend policy to a total dividend distribution of 60 percent of headline earnings for the year with an interim dividend of 40 percent of interim headline earnings.

Declaration of ordinary dividend

In accordance with the newly adopted dividend policy of paying 40% of headline earnings for the six months ended 30 September 2016, ordinary interim dividend number 19 of 131.23874 cents per share (March 2016: 270 cents) in respect of the period ended 30 September 2016 has been declared payable on Monday, 5 December 2016 to shareholders recorded in the register of the company at close of business on Friday, 2 December 2016.

The dividend will be subject to a local dividend withholding tax rate of 15 percent which will result in a net interim dividend of 111.55293 cents per ordinary share to those shareholders not exempt from paying dividend withholding tax. The ordinary dividend will be paid out of cash balances.

The number of ordinary shares in issue at date of this declaration is 526 948 698. Telkom SA SOC Limited’s tax reference number is 9/414/001/710.

Salient dates with regard to the ordinary interim dividend 2016

| Declaration date | Tuesday, 15 November 2016 |

| Last date to trade cum dividend | Tuesday, 29 November 2016 |

| Shares trade ex dividend | Wednesday, 30 November 2016 |

| Record date | Friday, 2 December 2016 |

| Payment date | Monday, 5 December 2016 |

Share certificates may not be dematerialised or re-materialised between Wednesday, 30 November 2016 and Friday, 2 December 2016, both days inclusive.

On Monday, 5 December 2016, dividends due to holders of certificated securities on the South African register will be transferred electronically to shareholders’ bank accounts.

Dividends in respect of dematerialised shareholders will be credited to shareholders’ accounts with their relevant CSDP or broker.

Results from continuing operations

The group recorded a reported profit after tax of R1 821 million (September 2015: R606 million). This is 200.5 percent higher than the prior corresponding period and was mainly as a result of voluntary early retirement and severance package costs of R1 523 million and the related tax impact of R446 million in the prior corresponding period.

The once-off items above are not part of the results from normal operations for the prior corresponding period under review and have therefore been excluded from the discussion below.

On a normalised basis the Group profit after tax increased 8.2 percent compared to the R1 683 million profit after tax recorded for the prior corresponding period. EBITDA increased 4.6 percent to R5 272 million (September 2015: R5 040 million), resulting in a 19.7 percent increase in headline earnings per share. The increase was driven by higher net operating revenue and flat operating expenses. This was partly offset by lower gains from sale of assets.

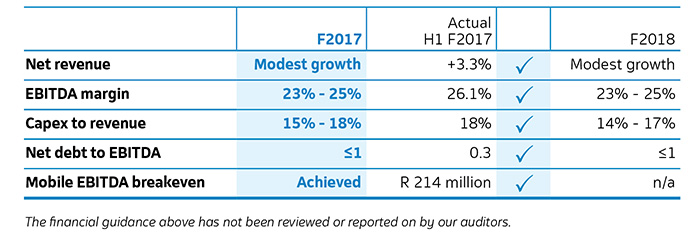

Financial guidance

The conclusion of the acquisition of the entire share capital of BCX and the termination of negotiations to sell our 64.9% shareholding in Trudon due to certain pre conditions not being met, have required us to review and revise our financial guidance for the year ending 31 March 2016.

The revised guidance provided below includes the financial performance of Trudon for the full financial year and BCX for the seven months since acquisition. The only change in guidance is the EBITDA margin from 26%-27% to 24%-26% due to the inclusion of BCX.